112

GROUP

CO-OPERATIVE

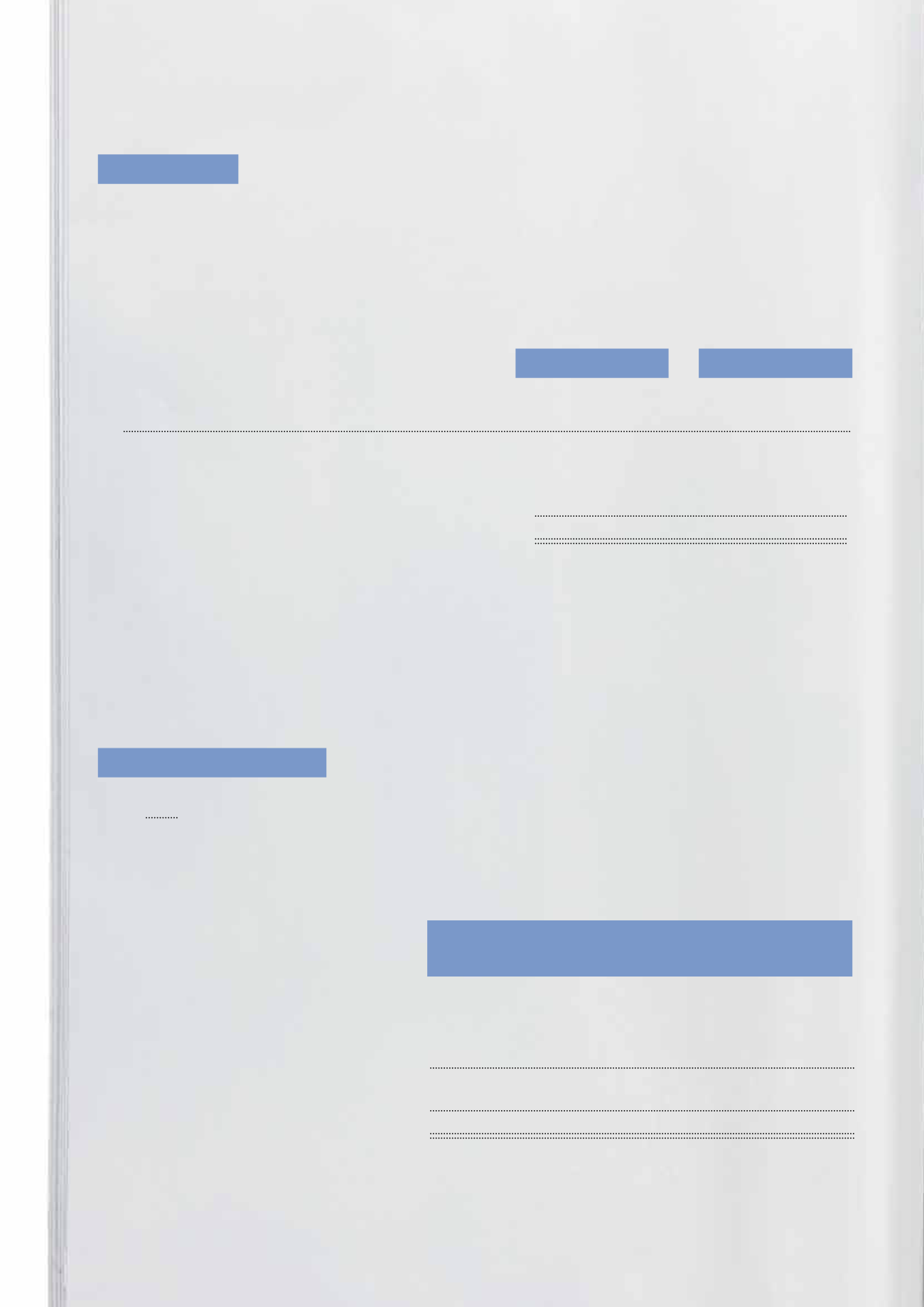

This relates to the provision for reinstatement cost for the estimated costs of dismantlement, removal or restoration

of property, plant and equipment arising from the acquisition or use of assets, which are capitalised and included in the

cost of property, plant and equipment.

Movements in the provision are as follows:

Group

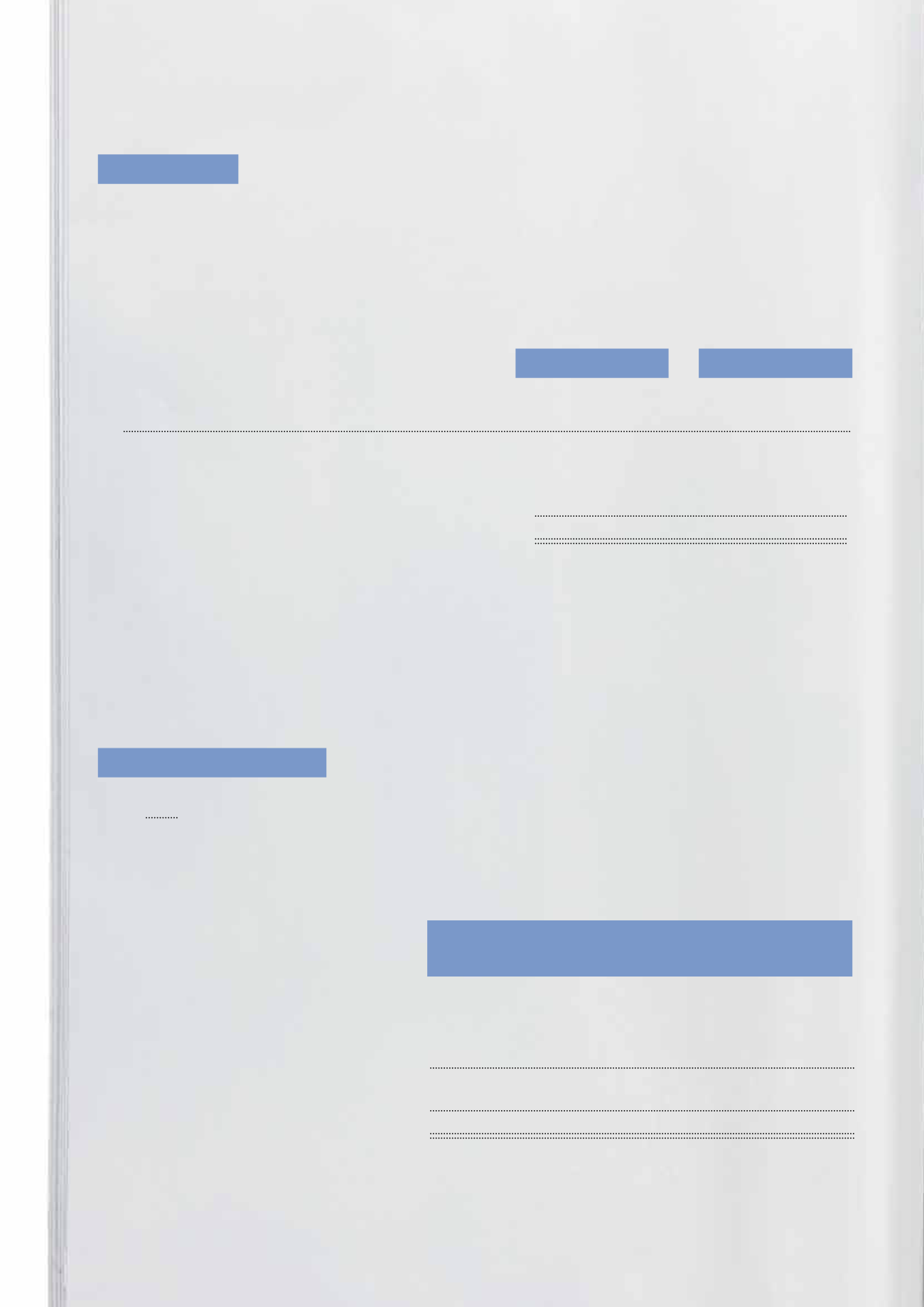

The following are the major deferred tax liabilities and assets recognised by the Group, and the movements thereon,

during the current and prior reporting periods:

A provision for reinstatement cost is recognised when the Group and the Co-operative have a legal and constructive

obligation to rectify wear and tear to leased premises under property lease agreements with external parties.

The unexpired lease terms range from 0.08 to 14.08 years (2012 : 0.08 to 4.83 years). The provision is based on the

best estimate of the expenditure with reference to past experience. It is expected that these costs will be incurred after

one year from the balance sheet date. The provision is discounted using a current rate of 5% (2012 : 5%) that reflects

the risks specific to the liability.

19. PROVISIONS

20. DEFERRED TAX LIABILITIES

2013

2012

2013

2012

$’000

$’000

$’000

$’000

At beginning of the year

21,956 23,896

20,884 23,018

Utilisation of provision

(172)

(2,891)

(113)

(2,832)

Provisions made during the year

1,876

951

1,727

698

At end of the year

23,660 21,956

22,498 20,884

$’000

$’000

$’000

$’000

At April 1, 2011

2,523

-

(184)

2,339

Credit to profit or loss for the year (Note 26)

(177)

(935)

-

(1,112)

At March 31, 2012

2,346

(935)

(184)

1,227

Charge to profit or loss for the year (Note 26)

1,123

-

298

1,421

At March 31, 2013

3,469

(935)

114

2,648

NOTES TO FINANCIAL STATEMENTS

March 31, 2013

Accelerated

tax

Unabsorbed

depreciation donations

Provisions

Total